A Wrong Way vs. Right Way Guide to Supply Chain Finance

By • Published October 10, 2019 • 3 minute read

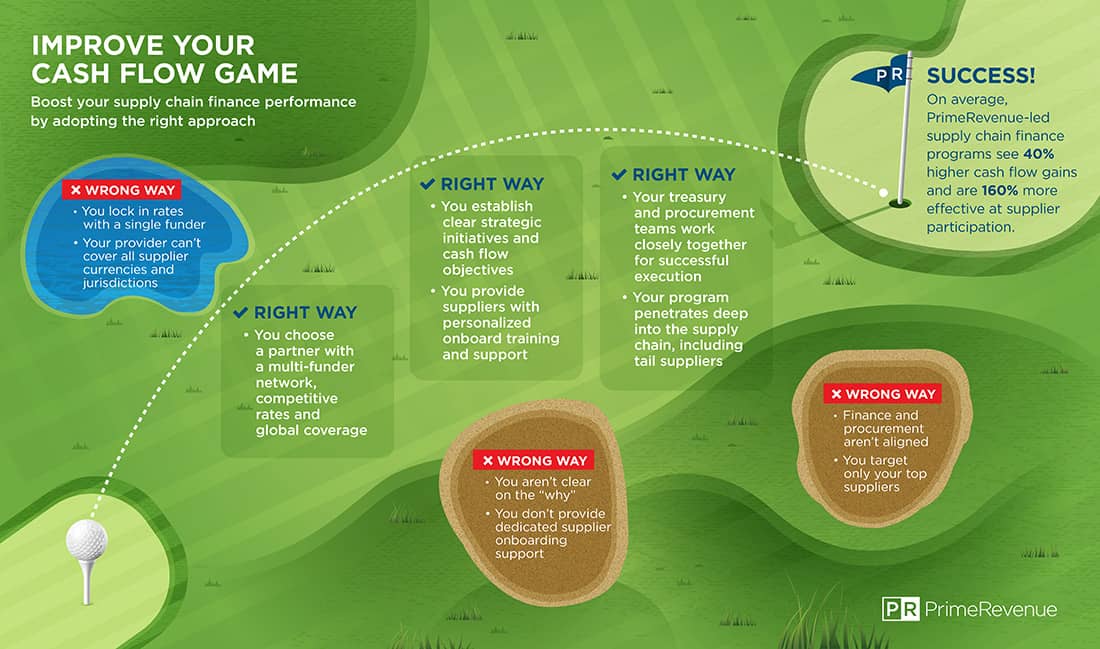

What makes certain supply chain finance programs perform leagues above the rest? What makes others fall flat? We’ve found that most of the time, perfectly viable programs fail simply due to inadequate objectives and a poorly thought out strategy.

While no two programs are the same, there is certainly a right way and a wrong way to approach supply chain finance. Over the past 16 years, we’ve gained insight into best practices that help our 30,000+ clients more quickly see impressive results and continual growth.

Unlike many traditional solution providers (typically banks) that might be stuck in the conventional approach to supply chain finance, we understand an innovative, strategic methodology is key if you want your supply chain finance program to deliver material cash flow gains, attract suppliers and grow over time. This starts with a multi-funder approach, which ensures your program is well funded even if a bank exits a market or pulls back funding, and extends working capital analysis, goal-setting, supplier communications and internal stakeholder alignment.

If you’re wondering how to get the most cash flow gain out of your supply chain finance program – or what missteps you should avoid – check out the infographic below.

Questions on what makes a successful supply chain finance program? Download this guide.