NEWS

In this age of ever-increasing competition, trade wars, tech-driven disruption and sustainability considerations there is more urgency than ever for companies to strengthen their supply chains. One of the ways in which companies are increasingly looking to achieve this is by implementing supply chain finance or supplier early payment programmes.

These programmes typically allow companies to optimise their own working capital whilst simultaneously injecting liquidity into their supply chain ecosystem. The programme provides suppliers access to cash earlier than they might otherwise achieve, at a discount typically less than the cost of financing their receivables on bank facilities.

The challenge, however, is to ensure that the programme is as dynamic and scalable as the ecosystem in which the company operates. The key here is to understand and appreciate that the supply chains of multinational businesses are rarely static and rather tend to evolve in response to, amongst other things, organic growth strategies, acquisitions, changes in regulation and legislation, shifts in global demand and moves to lower cost production sites.

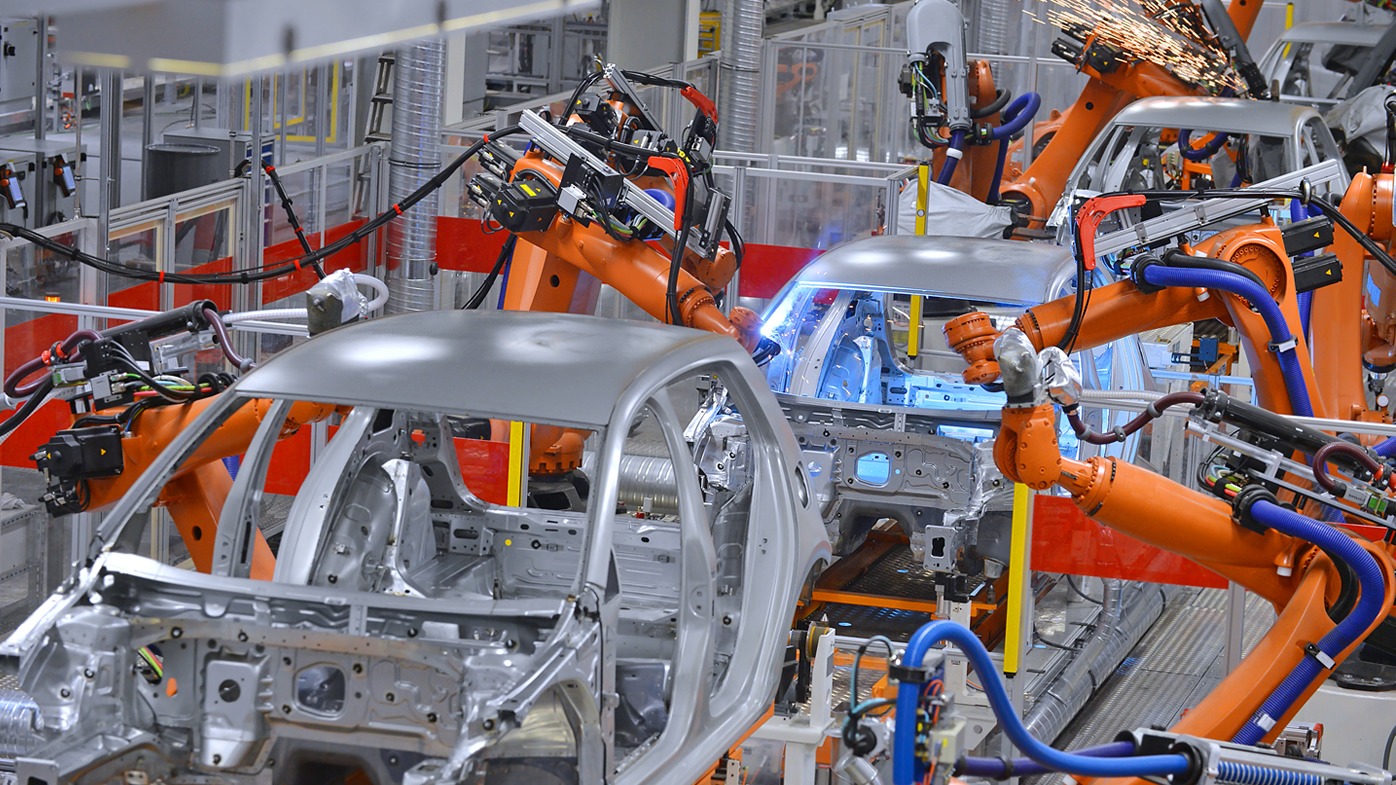

A good example of where shifting dynamics in a global supply chain ecosystem can be observed is in the automotive sector. The rapid pivot to e-mobility (as well as the shift to outsourced mobility) is forcing automotive OEMs to reconsider their strategy from several angles.

The disruption caused by niche manufacturers such as Tesla, mobility players such as Uber and tech companies like Google, means that traditional OEMs are increasingly focussed on re-tooling their production lines, investing in R&D, taking cost out of the business and becoming as capital efficient as possible in order to remain as agile as possible.

So how can companies respond to these challenges by implementing supply chain finance programmes that are adaptable and scalable? The answer lies in the capabilities of the provider.

Traditionally, supply chain finance is too inflexible to cope with the change

The supply chain finance space has historically been dominated by bank providers. These providers had the advantage of easy access to liquidity, a proprietary platform to facilitate supplier trading and a network of clients, which helped in the proliferation of supply chain finance as a concept amongst both buyers and suppliers. In certain circumstances this model still works well today, and many banks continue to offer competitive supply chain finance products.

However, when faced with a rapidly evolving supply chain ecosystem, supply chain finance provided by banks has its limitations. The first issue is that, in my experience, banks still tend to operate in silos when it comes to credit assessment, appetite for supplier on boarding, legal agreements and even technology platforms. Furthermore, supply chain finance within a bank is usually one product competing for airtime and investment amongst many other products, rather than an end-to-end solution.

Secondly, banks operate under increasingly significant regulatory constraints. This can affect their ability to offer certain products in certain markets, particularly where those regulatory changes or constraints affect the capital treatment, meaning a bank is more likely to take the decision itself to pull out of particular products and/or markets.

Finally, most banks have limited capabilities when it comes to covering the jurisdictions, currencies and number of suppliers demanded by companies faced with rapidly evolving and expanding supply chain ecosystems. International banks tend to work predominantly with corporate and institutional clients outside of their home markets and have limited capacity and appetite for smaller suppliers. Conversely, local banks are better at covering medium and small suppliers, but lack the ability to offer global or regional visibility meaning a fragmented structure which is not scalable.

There is a better way

All of these factors necessitate a better solution for providing supply chain finance. Companies should now have an expectation that SCF providers will take a broader view of their supply chain ecosystem, not just looking at their own client, but also to that client’s suppliers and customers. They should also expect to be able to offer supply chain finance in multiple jurisdictions without having separate logins to different technology platforms.

Companies should expect that they can work with one global solution and bring in the optimal mix of liquidity, currencies, supplier coverage and jurisdictions. Not only that, but when the supply chain ecosystem materially changes, as it undoubtedly will, companies need to know that their solutions will flex and scale to accommodate those changes.

When companies are assessing supply chain finance as a mechanism to strengthen the supply chain, it is important that they have a plan for how they will address the challenges of a rapidly evolving supply chain ecosystem. Choosing a provider that is agile enough to adapt and scale the challenges of tomorrow could make all the difference.