New Data: Interest Rate Impact on Supplier Early Payment

By • Published September 20, 2022 • 4 minute read

Last month, I wrote a post about how rising interest rates are impacting early supplier payments. Since that time, the European Central Bank has raised rates yet again and it’s likely another sizeable rate increase will be announced by the Fed very soon.

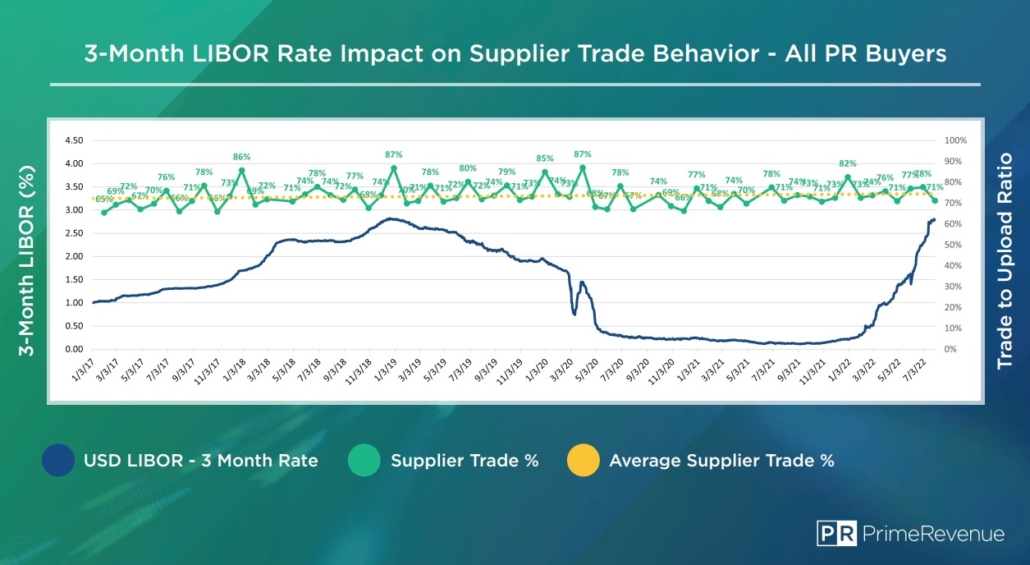

PrimeRevenue’s CEO, PJ Bain, summed up the impact on supplier invoice trading behavior rather succinctly last month: “We have found that, from an analysis of customer data, interest rate increases have had zero impact on supplier trading behavior.”

Several weeks later – despite historic inflation and aggressive efforts to tame it – that analysis still holds true. In reviewing the percentage of invoices suppliers have submitted (or traded) for early payment, the numbers have held steady across several global economic disruptions. These disruptions include the 3-month base rate (LIBOR) rising above 3% for the first time since Halloween 2008 (!!) as well as the fallout from a worldwide pandemic. Walking back from 2022 to 2017, August supplier trade behaviors were 74%, 70%, 74%, 72% and 71%.

Another observation worth considering is the historical perspective of interest rate fluctuations. Since the financial crisis (2007-2009), federal monetary policies have artificially kept interest rates at historical lows. And while the increases recently announced by central banks have been large in scope, the current environment is much more the norm than the exception. The average 3-month LIBOR since its inception is 3.51%. We’re at 3.57% as of the date this piece was published.

Supply Chain Finance Remains One of the Cheapest Liquidity Options

The key takeaway here is that supply chain finance remains one of the cheapest sources of liquidity available to suppliers. Other options are becoming significantly more expensive, especially for suppliers that are unrated or are rated as sub-investment grade. Because supply chain finance rates are based on the credit rating of the buyer (typically a larger company), suppliers are able to tap into liquidity at rates that are far lower than what’s available to them via other options.

Below is a snapshot of how supply chain finance compares to alternative sources of capital:

- Commercial Paper (unsecured, short-term loan): Adds debt while doing nothing to improve the cash conversion cycle. Supply chain finance doesn’t add debt to the buyer or supplier’s balance sheet while improving cash flow metrics.

- Corporate Debt/Bonds: Debt – particularly now – is costly and can have a negative impact on the balance sheet. Supply chain finance doesn’t add to/create debt and overall financing costs are lower.

- Cost Cutting: Cost cutting is typically disruptive, painful and introduces risks to the business. While supply chain finance doesn’t always replace the need to cut costs, it can be used to minimize these measures.

With every rate hike, supply chain finance solutions are becoming a more attractive way for companies to access affordable liquidity and improve cash flow. As the data shows, it’s a steady, proven way to better financial health in any economic climate.