Interest Rate Impact on Supplier Early Payment

By • 4 minute read

The Federal Reserve continues to raise interest rates.

These increases can affect all types of funding, regardless of industry. So what does this mean for your suppliers?

Coupled with the supply chain’s fight against inflation, materials are more costly whether you’re purchasing to manufacture or to resell.

Are any funding options available that won’t force suppliers to increase their prices or push them out entirely? According to our data, there is: supply chain finance.

Where Our Data Shows Consistency

Supply chain finance (SCF) is a means for buyers to pay their invoices at a later date while still providing faster access to cash for suppliers. Typically, funders purchase a buyer’s invoice for a nominal fee, extending the payment term for that buyer while paying the supplier before the invoice’s maturation date. Afterwards, the buyer pays the bank the invoice amount directly.

Minimizing the effects of soaring interest rates on both loans and debt, trends show that while other financing methods are becoming more expensive, SCF will hold relatively steady.

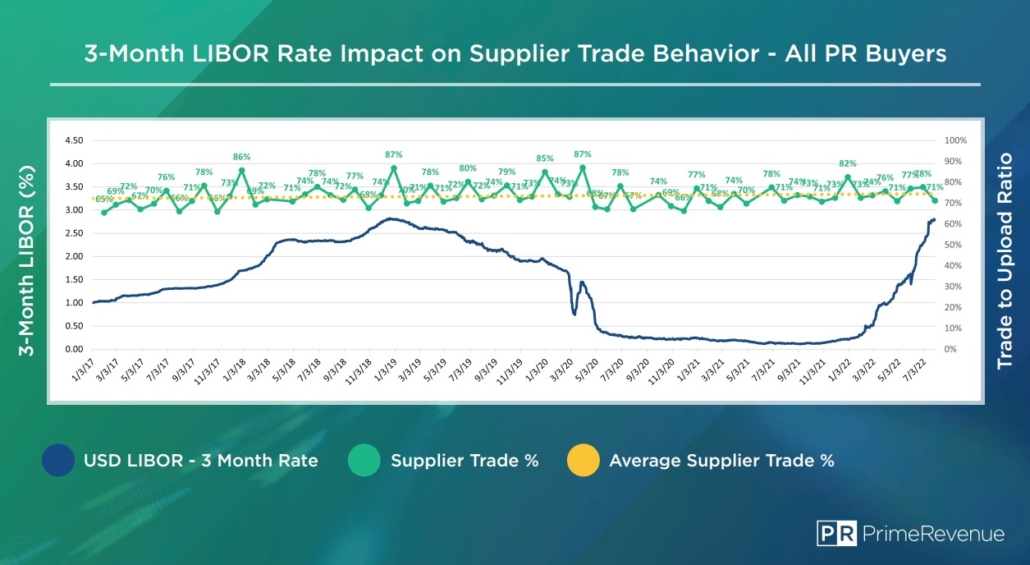

We’ve found that interest rate increases have had zero impact on supplier trading behavior over the last 5+ years. Early payments have remained steady (~75+%) despite the base rate fluctuating between 0.1% to 2.75+%.

Why SCF is Still a Great Solution

For smaller sub-investment companies, SCF may be the best option for financing. Their rates increase faster than for investment grade businesses, so a smaller company is left having to pay painful amounts to keep in business, risking accessibility to customers.

Through SCF, trading doesn’t falter as much. In 2009, Electrical Components International (ECI) was a major supplier to Whirlpool, who was running a supply chain financing program with PrimeRevenue. ECI needed funding and relied on SCF to keep their business from going bankrupt.

Supply chain finance offers a lifeline.

BCR Publishing Ltd. estimates that the corporate SCF market increased $1.8 trillion globally last year, or 38% compared to 2020.

Buyers with recent inventory bulk are launching SCF programs to bridge the gap between their supply chain needs and extending their payment terms. For suppliers, this level of demand can mean a relatively cheap and consistent source of cash.

Partnering with PrimeRevenue to participate in SCF could help you. Reach out to our TEAM to learn more about SCF or investigate further on your own with our whitepaper: 7 Financial Metrics Strengthened by Supply Chain Finance.