AP Automation: The Gateway to Successful Working Capital Initiatives

By • Published August 3, 2022 • 4 minute read

What do the most successful working capital initiatives have in common? It’s a question we reflect on often at PrimeRevenue and the answers cover a lot of territory. There’s programmatic stuff like onboarding and messaging. And then there’s strategic stuff like internal stakeholder alignment. But perhaps most important is the fundamental stuff – namely AP automation.

Why? AP automation is foundational to cash flow health and efficiency. It is the structural underpinning that allows companies to frictionlessly execute their working capital initiatives (e.g. supply chain finance, dynamic discounting, etc.).

As we’ve talked about before on this blog, manual AP processes are a huge burden for buyers. With personnel resources in short supply, AP staff spend an inordinate amount of time handling supplier payment inquiries, reconciling errors and reporting. Our research indicates the average cost to process a supplier invoice is $17. The AP automation delivered through PrimeRevenue’s end-to-end AP platform brings that cost down to $5.

But It’s Not Just About Costs

When it comes to AP automation benefits, reducing AP costs is just the start. Coupling AP automation with a B2B payment platform that handles all supplier payments unlocks valuable supplier insights that future-proof cash flow optimization.

When our customers choose the PrimeRevenue Platform to process B2B payments, all their suppliers are onboarded onto the platform. That’s great news for companies that are thinking about launching a supply chain finance program in the future. If and when they’re ready to engage in supply chain finance, the work of onboarding hundreds of suppliers onto a supply chain finance solution will already be done. We’re essentially removing friction before it’s ever realized so buyers and suppliers can get the most out of an early payment program. Furthermore, buyers can monitor supplier invoice and payment behavior to understand which suppliers may be better positioned to benefit from supply chain finance.

From a supplier perspective, AP automation provides payment certainty in time and date, guaranteed date, and sum-certain payment. Simplified access to early payments provides suppliers with the ability for next-day payment in order to stabilize and make investments in their business as needed. These benefits equate to something much bigger – cash flow confidence that leads to better business decision-making.

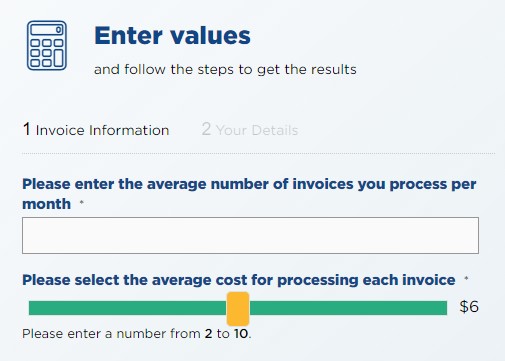

Introducing PrimeRevenue’s AP Efficiency Calculator

AP automation for on-time payments is the gateway to successful working capital initiatives – whether they’re already in progress or in the future. To fully understand the impact AP automation can have on your business, we’ve created our AP Efficiency Calculator. Simply enter in your average volume of invoices and average processing cost, and we’ll show you how much PrimeRevenue’s AP automation solution can save you on an annual basis.