Regional Performance Indicates Resiliency in Europe, But Liquidity is Still Critical

By • Published June 17, 2020 • 6 minute read

In March and April, I published two blogs examining China’s trade activity, also known as purchasing volume, on PrimeRevenue’s platform to determine what we can expect to see moving forward. The first post showcased early indications that China may be coming back online; the second hypothesized what stabilization in China trade activity could mean for the rest of the world.

Since then, we’ve analyzed additional regional and industry trends. My colleague Nathan Feather reported that while no industry has been able to escape the impact of the global health crisis, the pandemic’s effects vary widely between different industries and sectors within the same industry. Because of this, each sector has different liquidity needs to overcome industry-specific challenges today and tomorrow.

Our data tells a similar story among various regions in the world. As we continue analyzing trade activity, we see a clearer potential timeline to “getting back to business” and how this compares to individual regional performances.

Across all regions, purchasing volume is consistently increasing from the lows we saw at the beginning of the pandemic. At its lowest point in early February, China’s trade activity on our platform, heavily weighted with manufacturing companies, was down 62% year-over-year compared to 2019. Four months later, it’s now down only 18%.

Throughout Europe, volume seems to be on an even quicker road to recovery. In only a month, volume is only 13% below 2019 volumes, up from its low point of 32% below 2019 in April. A preliminary analysis of U.S. purchasing volume shows a 41% drop in purchasing volume in April that is recovering at a much slower rate. Today, though, I’d like to break down what we’ve seen in Europe – both as a whole and regionally across the continent.

Data Shows Steady Increases in European Trade Activity

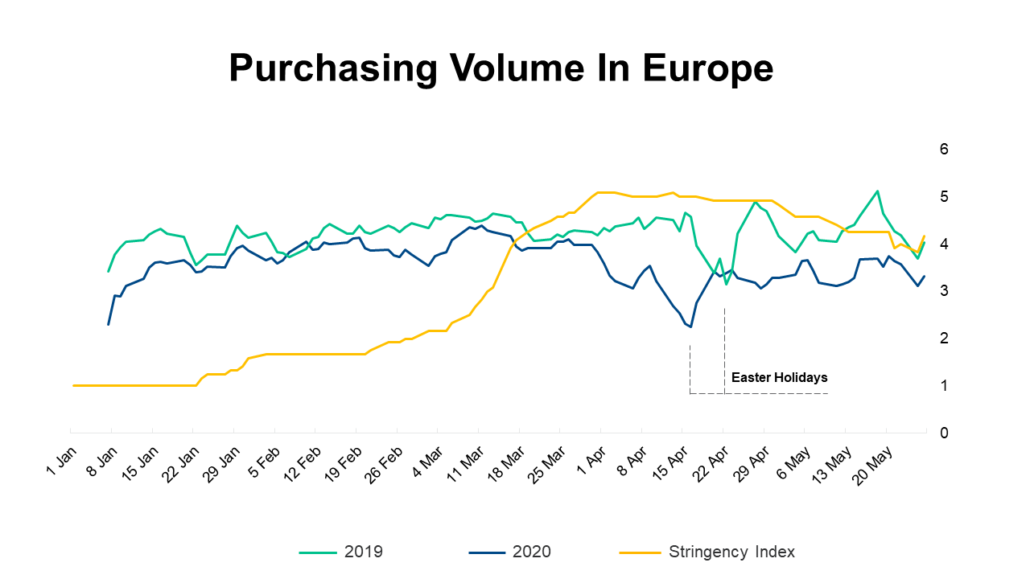

The graph below shows the 10-day moving average of purchasing volume from European businesses in 2019 and 2020. We’ve also overlaid a trend line of Europe’s stringency index, which considers policies such as school closures and travel bans, to monitor the intensity of lock downs and restrictions across Europe as a whole.

Stringency index trend line data courtesy of Hale, Thomas, Sam Webster, Anna Petherick, Toby Phillips, and Beatriz Kira (2020). Oxford COVID-19 Government Response Tracker, Blavatnik School of Government. Data use policy: Creative Commons Attribution CC BY standard

As you can see, purchasing volume began to decline drastically when government regulations and business closures were the most prominent between early April and early May. Our customers were responding in a number of ways: self-imposed employee safety measures, government-mandated shutdowns of non-essential industries, or simply the external effects of changing consumer demand as a result of social distancing.

We can see though that since these restrictions eased in May, European countries’ purchasing volume has returned closer to pre-COVID levels. We expect volumes to continue rising as consumer demand crawls back. However, returning to a “new normal” doesn’t guarantee purchasing will return to 2019 levels anytime soon.

Our funding TEAM assessed Europe’s economic outlook and told me they expect the region’s recession to continue until 2021 or later. While they have a solid track record on their assessments, it would be refreshing to see this theory disproved by seeing significant strides in our customer data resuming to pre-COVID and pre-recession levels earlier than expected. Nevertheless, today it is good news that this data indicates the economic side-effects of the global pandemic didn’t have as large or as sustained an effect on Europe as what we saw in China.

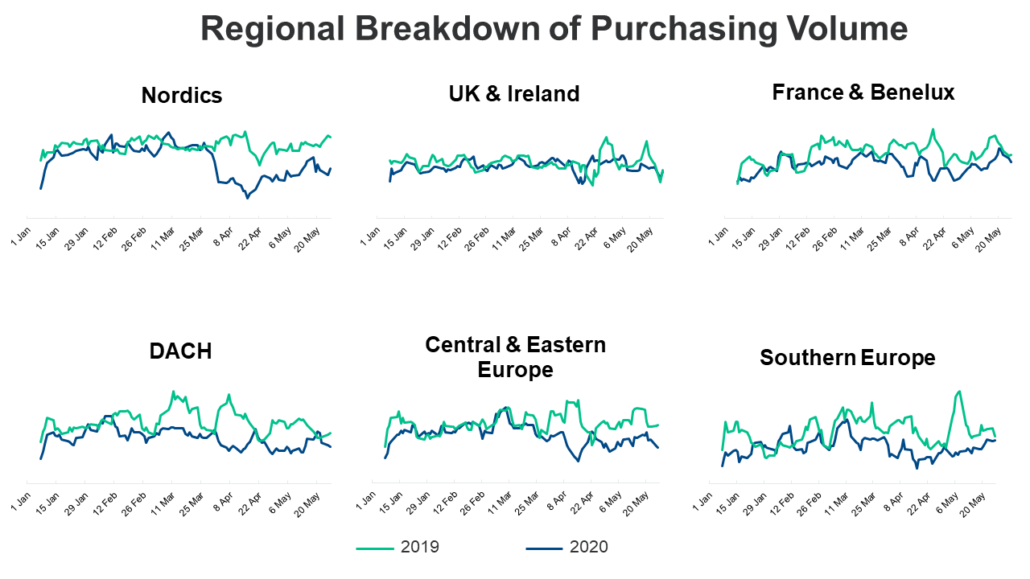

Notable regions where our clients are showing particularly strong resiliency are the UK and Ireland, France and Benelux, Southern Europe, and DACH. This may be for a variety of reasons:

For example, PrimeRevenue partners with a large portion of food retailers in the UK and Ireland. Further, the region shows the least amount of volatility in the charts above.

In DACH, purchasing volume remained steady compared to other regions in Europe. Germany, Austria and Switzerland have been praised for their early response to COVID-19, and they were some of the first European countries to ease restrictions. Therefore, consistent performance in the region makes sense. However, while volatility is less than other regions, trading volume is still drastically lower than 2019 over a longer period of time than what we see in other regions.

The Nordics region entails the best macro-economic representation because it has the widest variety of industries in our portfolio. While Sweden has the most relaxed restrictions in the region, Finland, Denmark, and Norway did have school closures, bans on large gatherings, and restrictions or closings of restaurants and bars. This may have had an effect on the dip in April.

Regardless of Region, European Companies Need Access to Cash

As we’ve pointed out, trade activity between buyers and suppliers continues to vary by industry and region. But one constant exists – the demand for liquidity is unprecedented.

Companies and their suppliers are using supply chain finance to broaden liquidity options and sustain themselves during disruption. Especially now, everyone needs access to cash and supply chain finance is one of the most economical means to get it compared to other options.

Mandy Earle of NAS Recruitment echoes this sentiment. The UK-based provider of recruitment services participates in DHL’s PrimeRevenue-led supply chain finance program to accelerate invoice payment:

“Good cash flow is especially important right now as our clients respond to the COVID-19 crisis,” she said. “Faster cash flow gives us the flexibility to meet changing client requirements.”

The road to recovery will not be easy. Companies need working capital to survive the current downturn and jumpstart production as business rebounds. For some, the recovery period will be longer than others, and having numerous liquidity options available is paramount.

Heading into the summer months, PrimeRevenue will continue to keep an eye on both trade activity and suppliers’ hunger for early payment. As we collect additional regional data, we will identify long-term trends across China, the broader APAC region, Europe and soon, the U.S. – all with the goal of helping businesses make more informed decisions today and tomorrow.