What Stabilization in China Trade Activity Could Mean for the Rest of the World

By • Published April 30, 2020 • 5 minute read

As China’s restrictions are lifted, suppliers patiently wait for the West to catch up

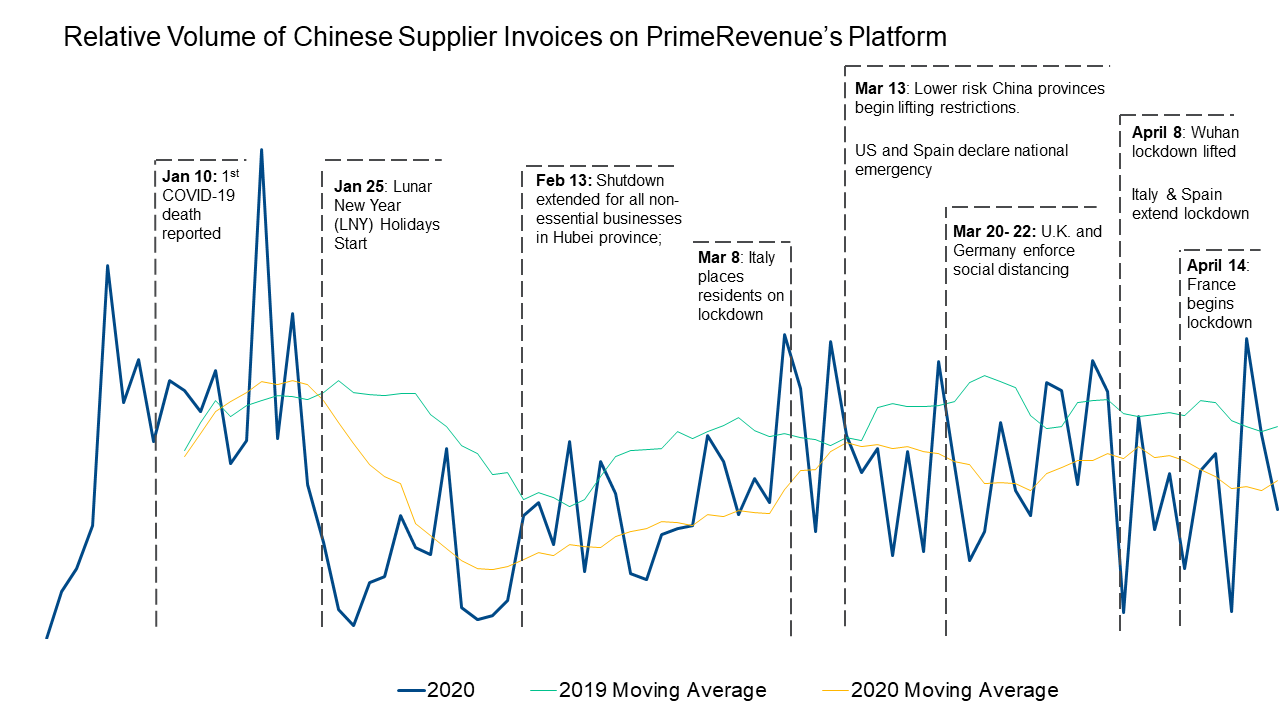

We reported a month ago that early indications showed China’s economy was coming back online. Based on our data, trade activity between Chinese suppliers and their customers began normalizing toward the beginning of March after a period of decline that began in February. As several Chinese factories came back online, we saw a brief period of 7 days where trade activity actually outpaced 2019 by 30 percent. However, we speculated the uptick in China’s trade activity could be short-lived as more countries locked down and demand decreased.

These observations were captured for suppliers across 20 territories in China and in many industries serving Western customers. As a reminder, the data captured on PrimeRevenue’s supply chain finance platform shows invoice value and is an indicator of trade transactions – if the overall value of invoices is growing, trade between buyers and suppliers is growing. Similarly, if volume is down, trade is down.

China Invoice Values Reflect Volatility in Demand from the West

Since our initial report, we collected an additional month of data. Outlined in the chart below, this new data provides a glimpse into how the global spread of COVID-19 has affected demand for Chinese goods and services.

The last 30 days have been extremely volatile, likely the result of the action and reaction unfolding across the globe as different regions are impacted by the global health crisis. Hard goods manufacturing, some retail and automotive sectors have been hit hardest. As Europe and the U.S. continue to experience varying degrees of lockdown, whether it be in store closings, factory shutdowns or reducing hours of operation, customers in these regions are producing less and placing fewer orders, resulting in lower invoice value.

Meanwhile, we are seeing major increases in invoice value for packaged food and some consumer goods as demand from the West and Australia increases in those areas. In fact, one packaged food customer on our platform has seen a 180% increase year-over year. Admittedly, our customer base has very few producers of medical equipment or Personal Protective Equipment (PPE) in China, which would lead to significantly higher volumes due to the current surge in demand.

This last month of data shows our predictions were accurate: reduced demand and global shutdowns have led to more volatility and lower trade activity compared to 2019. But there is some good news! The slumps have been relatively short-lived, compared to many early speculations on timeline, including our own. While volumes are down from the beginning of the year, they have consistently moved above the anemic lows we witnessed in early February.

This may be one indication that the global economy may bounce back quicker than some projections have anticipated, but this should be validated with global data and we would love to collaborate with you if you have large data sets like this. Demand for the goods and services the invoices on our platform represent is largely based out of Europe and North America – the regions still trying to flatten the curve and restart business. If volumes keep stabilizing, it would indicate a trend toward overall supply chain and economic stabilization and then, ultimately improvements with a hopeful turn to recovery.

We’re also seeing a sharp uptick – 300 % – in the number of suppliers in China joining our supply chain finance platform this year. This is indicative of two points. First, companies want to mitigate the financial risk in their supply chains with supply chain finance. Second, suppliers have a higher demand for cash during these uncertain times and are accelerating through the onboarding process at faster rates than expected. This is particularly dramatic in Europe and can be an indicator for what the US, which is several weeks behind in the pandemic, will see down the line. We will explore this topic more in a future post.

Looking Forward

Our analysis of supply chain finance trade activity offers an early look into economic activity and can help companies make decisions at a time when there’s little valid, accurate and available data to rely on. We will continue to monitor the data in China and elsewhere as countries reopen for business and share those insights with you.

Two more studies my colleagues and I are looking forward to sharing with the market in the coming weeks will cover industry-specific trends and supplier demand for cash flow.

Follow PrimeRevenue on LinkedIn to stay updated on all our latest insights.

Stay safe, strong and healthy everyone.