The Economic Outlook of 2023: Supply Chain Resilience is Crucial

By • Published March 1, 2023 • 5 minute read

With the first quarter of 2023 nearly passed, we’re looking ahead at what’s in store for the economic landscape this year. Overall, predictions indicate a more promising future, different from the one expected a few months ago. While business leaders consider the risks of decades-high inflation, rising interest rates, recession, bear market, geopolitical conflict, energy crisis, and vulnerable supply chains, the tides have turned.

Inflation is cooling, interest rate hikes have slowed in the US and hiring figures are strong and unemployment is low. And while businesses can bear to be a bit more optimistic at the moment, planning for sudden shifts or disruptions remains critical. This evolving economic ecosystem requires a new finesse in navigation – a thoughtful and strategic plan to ensure flexibility and resilience for the supply chain in its entirety.

Examining the Macroeconomic Landscape

With Europe in a more advanced recessionary state than the U.S., a global recession remains likely. Rising interest rates have directly impacted corporate debt, and this, in turn, has further increased the cost of labor, goods, and energy. In spite of this, the Eurozone’s economy has rebounded faster than expected since the turn of the year, leading investors to expect the European Central Bank to continue raising rates to a peak in September 2023 in its prolonged fight to reduce inflation.

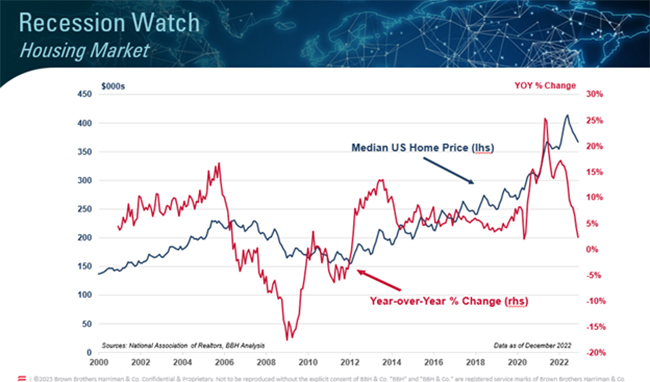

While the global market deals with an unstable labor market, economists are forecasting a more mild recession for the US based on recent data – particularly in the housing and labor markets. BBH Economist, Scott Clemons, reports that even though the home price drop feels reminiscent of the 2008 crash, today’s housing market is in a better position than before.

Europe’s Energy Crisis

A range of policy responses have been implemented in the face of the EU’s unprecedented energy crisis, as its ramifications have extended to a global scale. Ignited by the pandemic and further fueled by the Russia-Ukraine War, the energy crisis caused the prices of electricity and gas to surge.

With a mild winter and fast action though, Europe seems to have stabilized. Fragility still stems from geopolitical tensions – relations between the US & China and the war in Ukraine – posing the greatest risk to macroeconomic stability at this time.

Supply Chain Diversification for Resilience

As the world has rebounded from the pandemic and its massive shutdowns and re-openings, global businesses have been determined to diversify their supply chains. Diversification is a meaningful investment with long-term benefits. But in our currently challenged economic global state, it is important to remember that the 12-month outlook for supply chains, which are inherently nimble, is still uncertain. With debt becoming increasingly expensive, companies must improve their short- and long-term supply chain resilience strategies to remain stable – the key to which is maximizing liquidity and access to working capital.

Supply Chain Finance as a Tool

Supply chain finance is a tool that maximizes liquidity and cash flow by allowing buyers to pay their invoices later while providing faster access to capital for suppliers. The process – which involves a funder that purchases a buyer’s invoice for a nominal fee – operates outside of debt, so is still attractive to companies despite rate increases.

For businesses across industries, supply chain finance is a tool with untapped potential lying in their working capital. An efficient and affordable form of liquidity, it improves cash flow for both buyers and suppliers – a win-win solution providing buffers to recession and cash for diversification and scale.

Looking to the Future

While we remain in a post-pandemic recovery period and endure the impact of challenged supply chains, the future is beginning to show a light at the end of the tunnel. In the face of economic uncertainty though, business leaders should power strategy through information and awareness, remaining agile and resilient. The foundation for future success comes with knowledge, the right tools, and liquidity, especially in the most volatile times.