“Should our supply chain finance program be funded by a single multi-national bank? Or should it be funded by multiple banks?” It’s a major consideration when implementing supply chain finance.

It’s also a no-brainer. More banks are always better than one. Especially right now.

We believe there are serious risks with a single-funder approach that cannot be ignored. Let’s say your company runs a single-funder supply chain finance program. How susceptible are you to that one bank’s financial health? What happens if it pulls out of certain markets?

These are very real concerns. Case in point? Deutsche Bank. Last week, Deutsche Bank’s share price sunk to near-historic lows following reports that several key hedge funds started withdrawing funds to reduce their exposure. That comes after the U.S. Justice Department levied a $14 billion fine against the bank for dealings leading up to the financial crisis. These concerns have been fueled by financial and judicial woes highlighted in a comprehensive article by CNBC. Here’s an excerpt.

It’s been a tough two weeks for Deutsche Bank: The German lender has been hit with billions in fines from the U.S. Justice Department — though most market watchers expect the total penalty being floated by the United States is likely to be reduced — and there have also been reports that the German government won’t be helping the ailing bank.

Since a peak in July 2015, shares have fallen more than 65 percent and the stock has erased more than half of its market value, from nearly $50 billion to about $16 billion this week. Meanwhile, net revenue fell almost 21 percent in the first half of this year from last year, according to the company’s interim report.

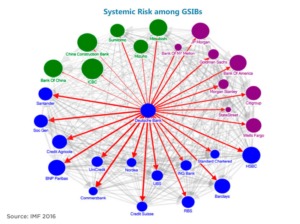

Even more concerning is the spillover effect that Deutsche Bank’s predicament could have on other large, multi-national financial institutions across all corners of the globe. This summer, the IMF released a report saying Deutsche Bank “appears to be the most important net contributor to systemic risks” in the global banking system.

The implications these scenarios could have on a single-funder supply chain finance program are disastrous. “Too big to fail” isn’t a dependable survival strategy and, when supplier transactions in certain geographies can’t be funded, the entire supply chain finance program is undermined.

This is the single most important reason why PrimeRevenue advocates a multi-funder approach to supply chain finance. There are a host of others (better price competition, fewer IT requirements, etc.) – but this one rises above the rest. The success of your supply chain finance program depends on the health of its funding. Why leave it to chance?

By

Published October 4, 2016