For a matter typically relegated to financial “nerds,” LIBOR seems to be getting its fair share of attention from a broader audience.

Unfortunately, much of that has to do with the recent scandal – but also because of those little basis point increases. Which is why I find myself having a lot of conversations about the impact of LIBOR on supply chain finance and what CFOs and treasurers are doing to improve their funding strategies in a rising rate environment.

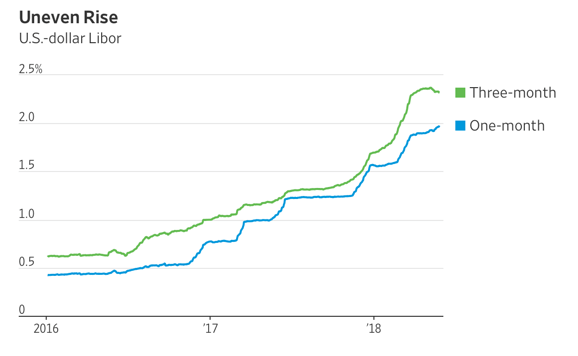

Here’s some context. In the last 12 months, the three-month USD LIBOR has increased by 103 basis points to 2.34%. The one-month rate is also on the upswing (albeit a lesser one) climbing 84 basis points to around 2.07%.

Because of the rate at which LIBOR is increasing, businesses need to strategically balance the mix of both short-term and long-term funding sources.

Most methods of external funding are subject to changes in LIBOR rates – including supply chain finance. There are some exceptions, such as cash on the balance sheet, fixed rate loans or loans that are hedged with derivatives. But, for the most part, all variable rate financial sources are susceptible to changing LIBOR rates.

The conversation I find myself having really focuses on three points:

Interest rates are going up for the foreseeable future, at least that’s what the Fed is indicating, and the market is pricing in. And to put this in context, they’ve been extremely low for the last 10 years.

Regardless of rate increases, supply chain finance still represents the best alternative to source cash at a low cost without incurring debt. If you need $500 million or $1 billion to fund that next acquisition, infrastructure upgrade, or AI-driven innovation, you don’t have to take a hit on your balance sheet or make tactical improvements to cash flow. Through supply chain finance, you can quickly unlock significant working capital that’s sitting there in your supply chain.

Don’t get hung up on LIBOR – it’s making a slow exit. LIBOR got a bad rep during the financial crisis due to being manipulated by a few bad apples. That has led to replacement equivalents, such as the Secured Overnight Financing Rate (SOFR) in the U.S. which the Fed began to publish this Spring. Similarly, the U.K. Financial Conduct Authority (FCA) announced its intention to phase out LIBOR by the end of 2021. It’s a considerable shake up considering more than $350 trillion of financial products are tied to LIBOR (ranging from swaps and derivatives to the large corporate non-investment-grade loan market).

Of all of the funding options available to buyers and suppliers (particularly non-investment grade suppliers), supply chain finance is still a winning strategy. This is especially true as rising rates tend to affect a company’s full funding mix. It’s more important than ever for companies to have access to non-debt cash.

By

Published August 9, 2018