Welcome to Your Partner Resource Center

Table of Contents

Marketing Collateral

Find our most up-to-date marketing assets including one page sell sheets and our PrimeRevenue overview slide deck for you to share with your clients.

Supply Chain Finance

Receivables Finance

Dynamic Discounting

Payables Finance

The PrimeRevenue Platform

PrimeRevenue Overview

Supply Chain Finance

Ideal Customer Profile

- Investment grade, with a yearly revenue over $500M

- Need for working capital initiatives (such as expansion efforts)

- Common industries: manufacturing, food and beverage, automotive, retail/wholesale, transportation/logistics and more

Talking To Your Clients

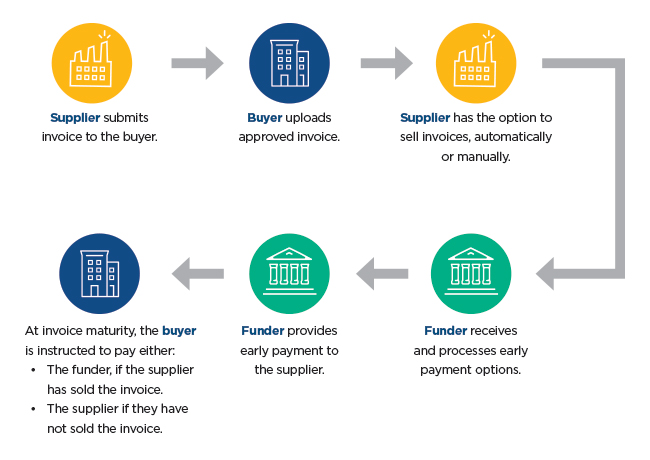

Supply chain finance, also known as supplier finance or reverse factoring, is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and SME suppliers to get paid early.

How it Works

Top 5 qualifying questions

Operations Process

During onboarding, we will work with your operational and technical teams to establish connectivity, develop the preferred file format and perform “penny tests”.

We work with your operational teams to integrate reports to book transactions to your back-office systems. In addition, we train your teams on daily operations management for the programs you will fund.

Referrals Process

Training Guide

How Supplier Registration Works

Step 1

Supplier registers

for the program

Step 2

Supplier completes

bank and legal documents

Step 3

Supplier uploads

invoices and gets paid early

Step by Step Supplier Onboarding

PrimeRevenue Platform Overview

Established in 2003, PrimeRevenue is the global leader in working capital finance solutions. More than 30,000 companies across the world leverage PrimeRevenue’s solutions to connect the entire financial supply chain through automated digital payments, increased payment visibility, enhanced control, and improved cash flow.

Supply Chain Financial Portal

Supply Chain Financial Portal seamlessly manages legal agreements, bank information, ESG Data and other documents you may want to automate onboarding within a self-service portal. This allows for centralized access to onboarding and education for successful supply chain program implementation.

Supply Chain Analytics

Supply Chain Analytics provides our buyers with proprietary data analytics, valuable supplier insights to help with strategic negotiations and in-depth working capital analysis to understand the opportunity, whether it be cash unlocked or P&L benefit. It also drives liquidity forecasting and a prioritized supplier rollout out strategy based on PrimeRevenue’s proprietary data, as well as third party financial information.

Dynamic Discounting

Dynamic Discounting is a solution that enhances buyers profitability by reducing Cost of Goods Sold, giving them the flexibility to choose when and how they would like to pay suppliers in exchange for a reduced price on the goods purchased. PrimeRevenue’s Dynamic Discounting program offers the flexibility to easily move suppliers to traditional Supply Chain Finance programs as they have excess cash to deploy, all in one platform.

Receivables Finance

Also known as Accounts Receivable (AR) finance, receivables finance allows suppliers to choose which invoices they want to sell to increase their cash on hand while enabling funders to easily expand their receivables program beyond what their current system and processes can manage, without any additional cost. This financing can be structured in a number of ways, but generally involves a company selling their invoices, minus a financing fee, prior to its customer paying the invoice, and securing early payment and improving cash flow.